Mortgage points break even

So you might have to pay four points to reduce your rate by a full. Check Your Official Eligibility.

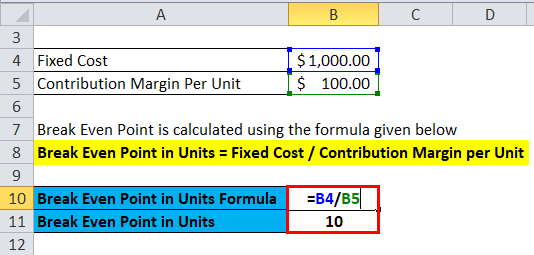

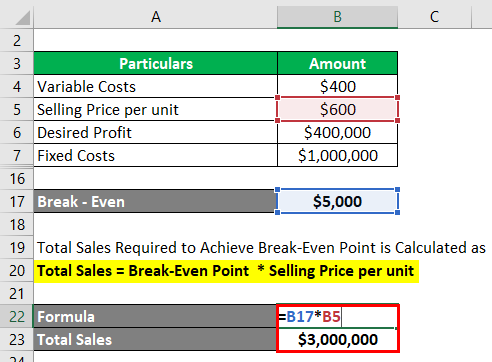

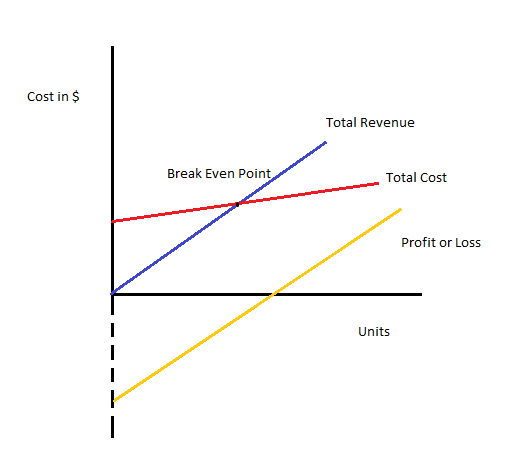

Break Even Analysis Formula Calculator Excel Template

After that you come out ahead.

. In that scenario you could potentially save as much as 11424 in interest by buying points. FHA VA Conventional HARP And Jumbo Mortgages Available. Mortgage Points Calculator 11a Break-Even Period on Paying Points on Fixed-Rate.

Keep in mind that assumes. Ad See Todays Rate Get The Best Rate In A 90 Day Period. Take Advantage And Lock In A Great Rate.

What More Could You Need. 1 point 4000. On a 200000 loan a 14 lower rate reduces the monthly payment by about 33 a month whereas 15 points amounts to 3000.

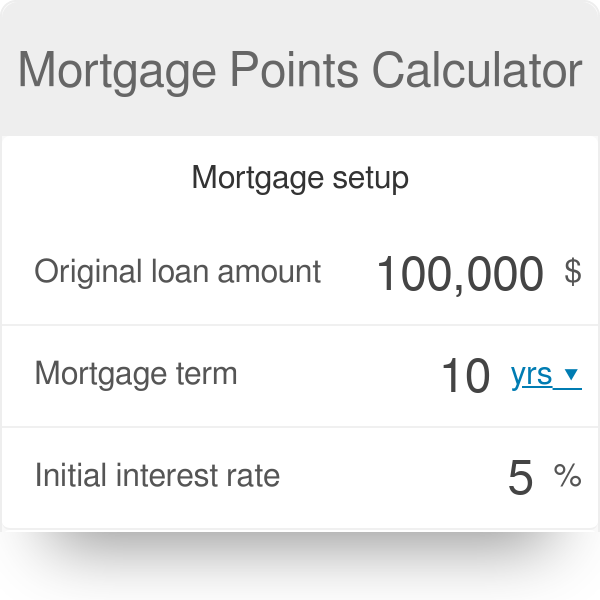

To determine the break-even point you divide your closing costs by the amount you save every month. This calculator shows the costs and benefits of paying points to reduce the rate on an FRM. Ad Updated FHA Loan Requirements for 2022.

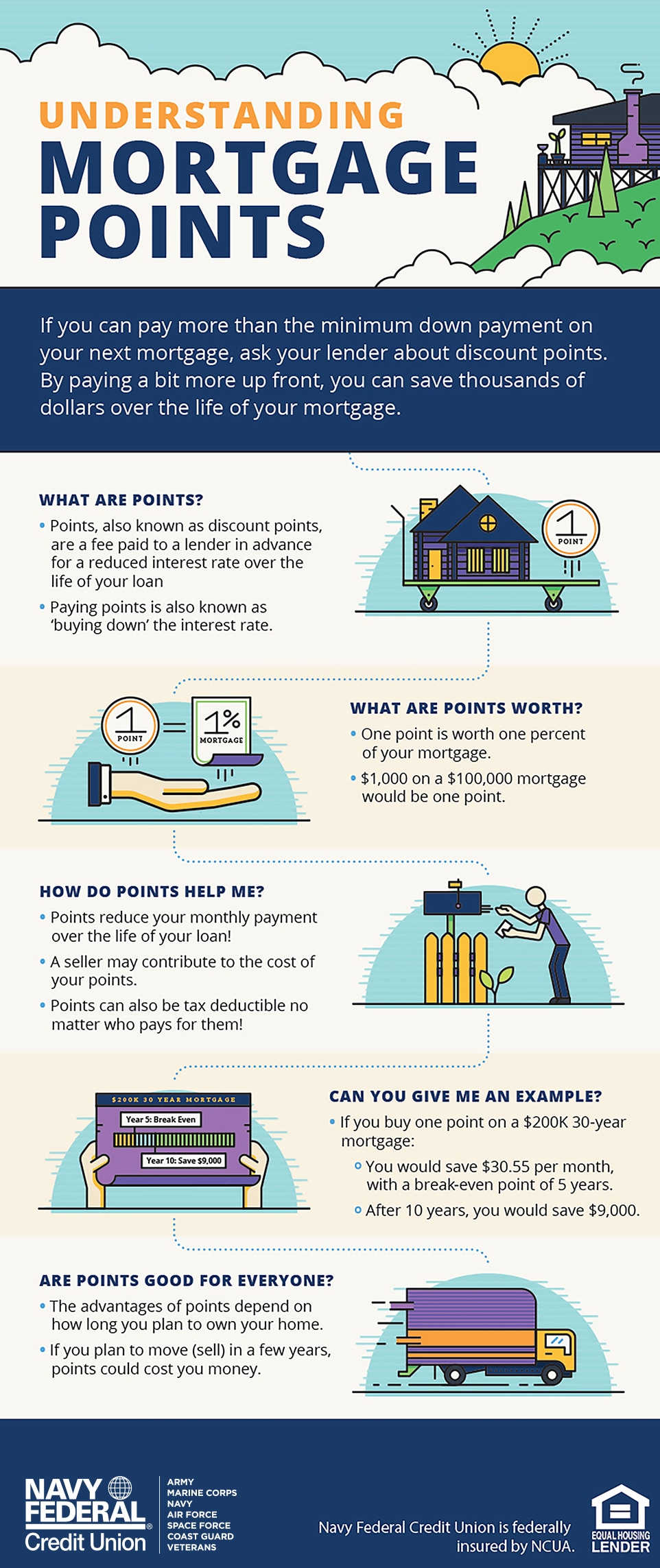

Up to 25 cash back Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025. Interest Saved by Refinancing. Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning.

However if you opt for the 175-point discount you end up paying 375586 over. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Dividing 3000 by 33 you get 91 months you have to.

Balance of Refinance at Breakeven Date. The concept of the break-even point is simple. What Is the Break-Even Point on a Mortgage.

To figure out when youll break even if you buy mortgage discount points take the cost of the points and compare it to how much youll save each month if you have a lower interest rate. Get The Service You Deserve With The Mortgage Lender You Trust. Each point you buy costs 1 percent of your total loan amount.

Lender Mortgage Rates Have Been At Historic Lows. In this example if you refinance your original mortgage with 5 rate into a 3 mortgage your. The result is the amount of time it would take you to breakeven on the.

When the accumulated monthly savings equal the upfront fee youve hit the break-even point. So if points cost you 2000 and saved 40 per month. The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments.

They sort of cancel. Get Your Estimate Today. Over 30 years without paying down the loan early the cost of the loan with interest is 391809.

Not only should the break-even point be before the time you plan to refinance the loan but it should also be less than the introductory period of the loan or else it wouldnt make sense to. The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. 1 point will lower your interest rate from 3 to 275.

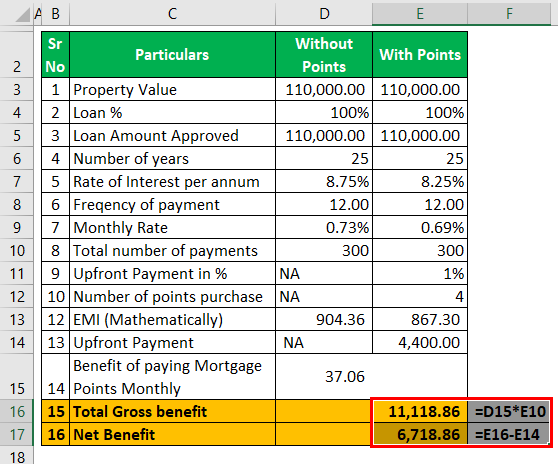

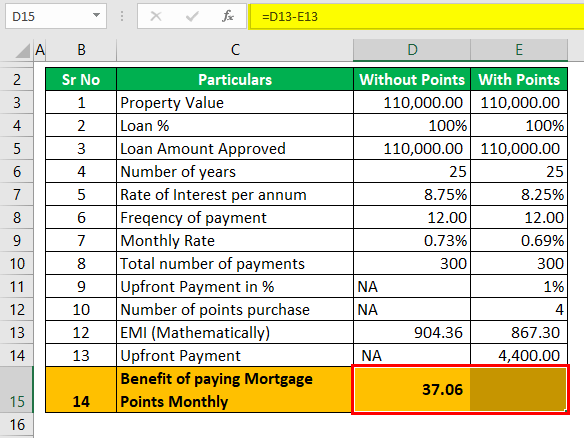

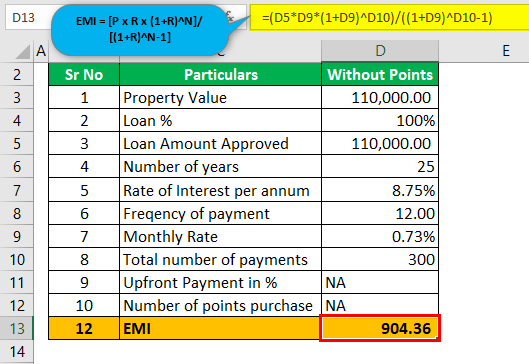

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points A Complete Guide Rocket Mortgage

![]()

Discount Points Break Even Calculator Home Mortgage Discount Points Explained

Mortgage Discount Points Calculator Mortgage Calculator

Mortgage Points A Complete Guide Rocket Mortgage

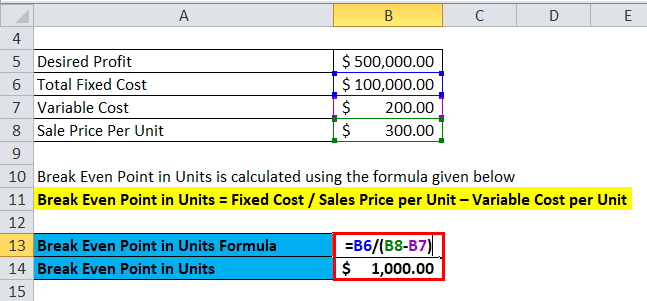

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

Mortgage Points Calculator 2022 Complete Guide Casaplorer

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Break Even Analysis Formula Calculator Excel Template

Mortgage Points Calculator

Mortgage Points Calculator Calculate Emi With Without Points

Break Even Analysis Example Top 4 Examples Of Break Even Analysis

Break Even Analysis Formula Calculator Excel Template

How Do Mortgage Points Work Navy Federal Credit Union

Mortgage Discount Points Calculator Mortgage Calculator